- CCP Commercial Office Digest

- Posts

- CCP Commercial Office Digest

CCP Commercial Office Digest

2/22/2024

Commercial Office Digest

Callahan Capital Partners is a real estate private equity firm focused exclusively on the origination, acquisition and management of high quality office assets throughout the United States.

Here's a glimpse into what we are reading to shape our view on the evolving office market.

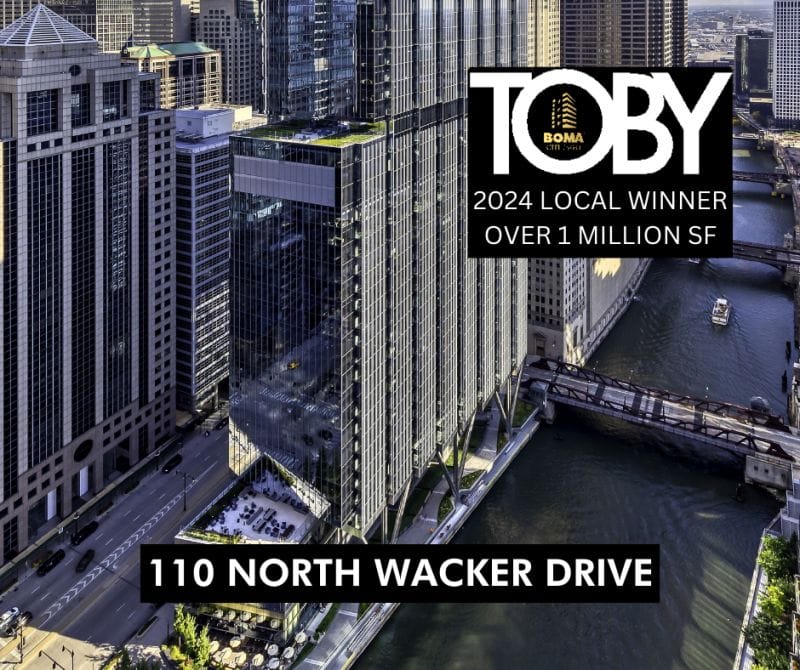

💥💥 CCP’s 110 North Wacker in Chicago was honored as the local winner of the 2024 BOMA The Building Of The Year (TOBY) award in the category of “1M sf +” for Chicago. 💥💥

“$929 billion of the $4.7 trillion outstanding commercial mortgages held by lenders and investors will come due this year.”

Asset owners have been largely able to delay public price corrections, but loan maturities will force both owners and lenders to re-evaluate valuations. Read more from Fortune here.

“The prevalence of top 100 leases in Class A and Class A+ buildings underscores an ongoing flight to quality in which companies prefer higher quality space in better locations in part to provide additional motivation for employees to work from the office more often.”

A CBRE analysis of the top 100 largest leases signed in 2023 notes that three quarters of the largest 100 leases came in higher quality (Class A and A+) buildings. If the focus is narrowed to new leases, 84% of square footage is in these higher quality buildings. Read more here.

“Uncertainty has contributed to the largest occupiers choosing to stay in place rather than relocate their headquarters…A declining amount of desirable trophy space and a slowdown in economic-growth forecast for 2024 may lead to this trend continuing.”

In New York, 23 leases over 100K sf were signed in 2023 (a YOY decrease of 18%), but 61% of those leases were renewals, compared to ~30% in prior years. Tenants are choosing to stay in place due likely due to a combination of uncertainty in space planning, the headache and cost of moving and a scarcity of the higher quality space they seek. Read more from CoStar here.

“Bank of America is cracking down on employees who aren’t following its return-to-office mandate, sending “letters of education” warnings of disciplinary action to employees who have been staying home…. Companies from Citigroup and Meta have been tracking whether employees have been going into the office, usually with a hybrid policy of three days in the office and two days at home, with similar warnings of discipline if employees don’t show up.”

The crackdown on remote work continues as companies push to get employees back to the office. While few are requiring a full time return to office, many are beginning greater enforcement of clear hybrid policies. Read more from The Guardian here.

Charts We are Talking About

We have shared this JLL graphic previously showing that 80% of national office vacancy is largely attributed to 30% of assets, however in this updated graphic, there is now an overlay of asset quality. The office assets JLL classifies as “Tier 1" (2015+ vintage, some of which are still leasing up), make up just 8% of national vacancy.

Feel free to share this newsletter. New subscribers can sign up HERE to be included on future Digest editions.

Questions? Thoughts? Want to connect? Please reach out to [email protected]