- CCP Commercial Office Digest

- Posts

- CCP Commercial Office Digest

CCP Commercial Office Digest

7/24/2024

Commercial Office Digest

Callahan Capital Partners is a real estate private equity firm and operator focused exclusively on the origination, acquisition and management of high quality office assets in select urban markets throughout the United States.

Here's a glimpse into what we are reading to shape our view on the evolving office market.

“The general public does not have a sense of the severity of the problem.”

Banks are feeling pressure from regulators and their own investors to reduce their commercial real estate loan portfolios, however the current inclination is to market deals privately so as not to draw too much attention. Read more from the New York Times here.

“Only 8% of office buildings are thriving, while most of the market has been struggling since the onset of the pandemic.”

While not great news generally for the office market, CBRE points out there is major leasing competition occurring at the highest end of office assets. Given the demand for this tier of office, availability is likely to continue to decline as developers halt office construction due to high vacancy rates and a tough lending market. Additionally, as the highest end of the market tightens, this likely pushes more leasing down to a Class A tier slightly below the highest quality assets. Read more from Bisnow here.

“With the second-highest number of AI-related job postings in the U.S., we’re clearly seeing a signal from big tech and government contractors that our talent is appreciated and desired greatly.”

Washington DC is projected to grow tech jobs by 8% by 2028. The boost is likely due to the increase in tech lobbying in the region, as tech companies continue to commit an increasing amount of capital to lobbying. However, DC tech job growth is not expected to be solely in lobbying. As tech firms set up satellite lobbying offices, there has been a trend towards co-officing other firm functions in DC as well, continuing to grow the tech presence in the region. Read more here.

Charts We Are Talking About

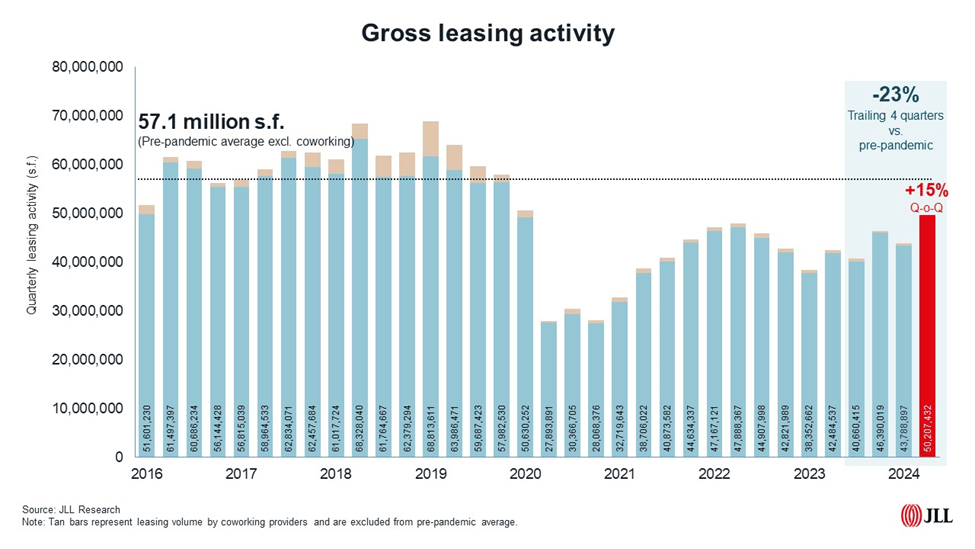

A JLL U.S. Office Outlook shows that U.S. office leasing activity surged in Q2 to the highest quarterly volume since the onset of the pandemic. The recovery in leasing activity was helped significantly by a growing volume of larger transactions above 100,000 s.f. Larger tenants have exhibited more confidence in recent quarters evidenced by the number of large leases per quarter growing consistently since the beginning of 2023.

Feel free to share this newsletter. New subscribers can sign up HERE to be included on future Digest editions.

Questions? Thoughts? Want to connect? Please reach out to [email protected]