- CCP Commercial Office Digest

- Posts

- CCP Commercial Office Digest

CCP Commercial Office Digest

1/23/202

Commercial Office Digest

Callahan Capital Partners is a real estate private equity firm focused exclusively on the origination, acquisition and management of high quality office assets throughout the United States.

Here's a glimpse into what we are reading to shape our view on the evolving office market.

“It’s a tale of two cities…If you’re in the best premium product in D.C., it’s going to be competition. “

In DC, despite overall market weakness, trophy office vacancy rates are at the lowest level in a decade as the flight to quality continues. Read more here.

“The broad, indiscriminate flight of institutional capital from the office sector has resulted in many high-quality properties trading down to historic lows.”

RXR and Ares believe the frozen office transaction market is at a breaking point, and are partnering on a $1B fund to acquire distressed Manhattan office properties. Read more here.

"Last year, the theme was paying up for less space, this year it was a lot of expansions."

In NYC, despite the slowdown in leasing generally the top of the market is expanding, with 196 leases last year signed for triple digit rents – the most ever on record. Most of these tenants are financial tenants who are growing and interested in expanding into highest quality spaces, the availability of which is shrinking with little new supply. Read more here.

“Meeting and collaboration spaces now account for 25% to 40% of new office space, up from just 10% or so a few years ago. [These tenant spaces] also function as flagship spaces, akin to flagship retail stores, that build a brand and attract talent. This is reflected in the resiliency and premium price points paid for signature buildings and Class A+ office space in superstar cities.”

The Rise of the Meta City in the Harvard Business discusses the '“hub city” and “satellite city” model that resulted when the pandemic expanded the possibility of remote work. The authors suggest companies must change their thinking about how their headquarters, innovation centers, satellite offices, and home offices all work together to promote productivity. Read more here.

Charts We are Talking About

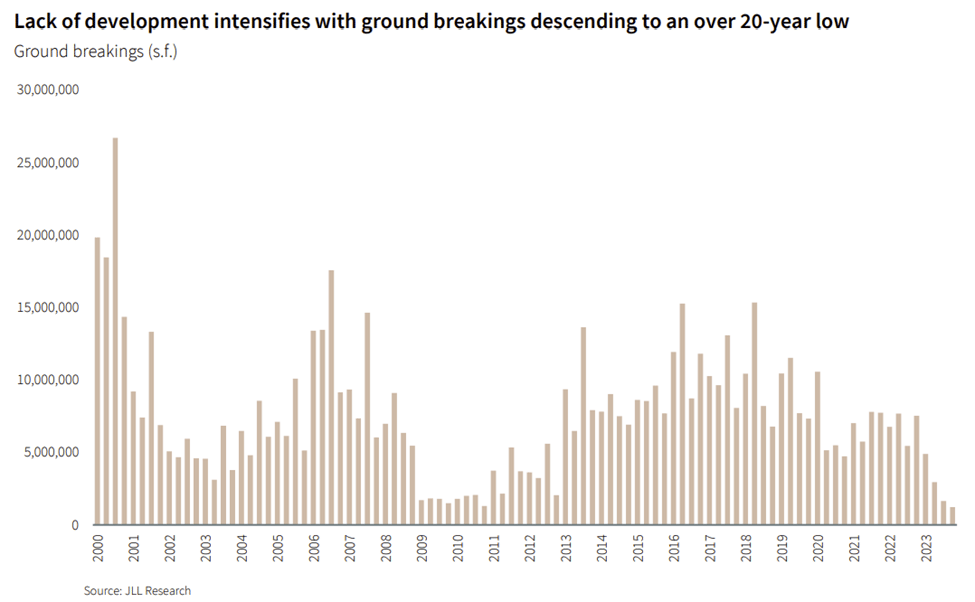

JLL notes the rapid decrease in upcoming office supply in their Q4 2023 US Office Outlook in the chart below. JLL projects that beyond the current data, office deliveries are expected to decline to roughly 35 million s.f. in 2024, 15 to 20 million s.f. in 2025, and potentially under 10 million s.f. in 2026. This lack of supply at the very top of the market is likely to drive spillover demand into the Class A market more broadly, as trophy rents grow and availability is slim. JLL notes that in Q4 2023, the signs of this spillover effect are becoming more evident, as Class A offices generally across all CBD submarkets essentially saw stable occupancy for over 1.1 billion s.f. of inventory.

Feel free to share this newsletter. New subscribers can sign up HERE to be included on future Digest editions.

Questions? Thoughts? Want to connect? Please reach out to [email protected]