- CCP Commercial Office Digest

- Posts

- Callahan Capital Partners - Office Real Estate Digest

Callahan Capital Partners - Office Real Estate Digest

1/15/2025

Callahan Capital Partners is a real estate private equity firm and operator focused exclusively on the origination, acquisition and management of high quality office assets in select urban markets throughout the United States.

Here's a glimpse into what we are reading to shape our view on the evolving office market.

Callahan Capital Partners and Probis Strategic Solutions Close on 101 Mission Street in San Francisco

We’re thrilled to announce that Callahan Capital Partners, in a partnership which includes Probis Strategic Solutions and another institutional partner, assumed ownership and operational control of 101 Mission Street, a 22-story, Class A office tower located in San Francisco’s South Financial District. The partnership will deploy new capital to reposition the approximately 213,000 square foot building into a premier workplace destination designed to meet the evolving needs of today’s office tenants. The acquisition comes as office demand in San Francisco shows meaningful signs of recovery, with recent market data indicating rising tenant activity, positive absorption, and renewed leasing momentum—particularly among technology and AI-oriented companies seeking high-quality space. You can find additional coverage of this transaction from CoStar and San Francisco Standard.

Market Spotlight on Dallas: “It's the economic dynamo of the country,”

A lot was written about Dallas over the past month. Dallas–Fort Worth was labelled the #1 market in the Emerging Trends in RE 2026 Report from ULI/PWC and is being heralded as the nation’s hottest “emerging” real estate market and a top destination for capital, due to DFW’s economic and corporate momentum. The rise of “Y’all Street,” and continued headquarters relocations have strengthened demand for top-tier, flight-to-quality office space and has resulted in surging rents, and interest from institutional buyers. However, the dynamism isn’t everywhere. The WSJ reported on the crisis of the Dallas CBD submarket which has the second highest office vacancy rate of any in the nation (behind Seattle). The contrast between submarkets within the same broader market is a reminder of the importance of considering the nuances at play within each market.

“For millions of workers, 2026 won’t be about resisting ‘Return To Office’. It will be about adapting to it.”

Inc. reports that return-to-office mandates are no longer causing employees to head for the door, as workers feel far less leverage in a shakier job market. A new survey shows the share of employees who say they’d quit over a mandatory RTO policy has dropped from roughly 50% last year to just 7% today, signaling a major shift in power back to employers.

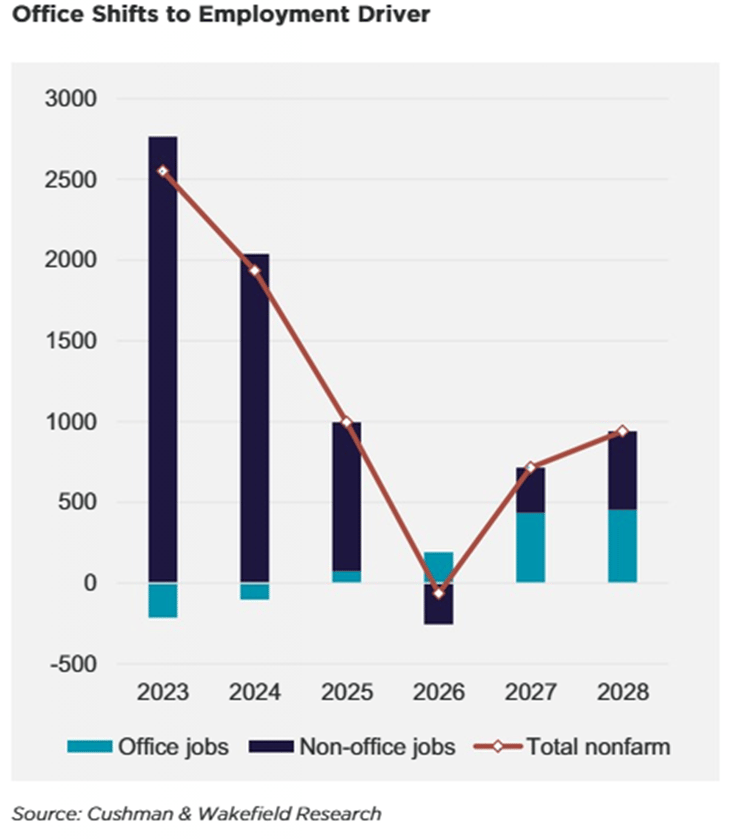

Charts We Are Watching

Per Cushman & Wakefield’s 2026 Office Outlook, after two years of stagnant growth, office-using employment is projected to rebound meaningfully, with an additional 625,000 jobs expected over the next two years. This will be a tailwind for office demand that should support higher leasing velocity, improved absorption, and gradually firmer Class A rent fundamentals, particularly in markets and submarkets offering modern, amenity-rich space.

Feel free to share this newsletter. New subscribers can sign up HERE to be included on future Digest editions.

Questions? Thoughts? Want to connect? Please reach out to [email protected]